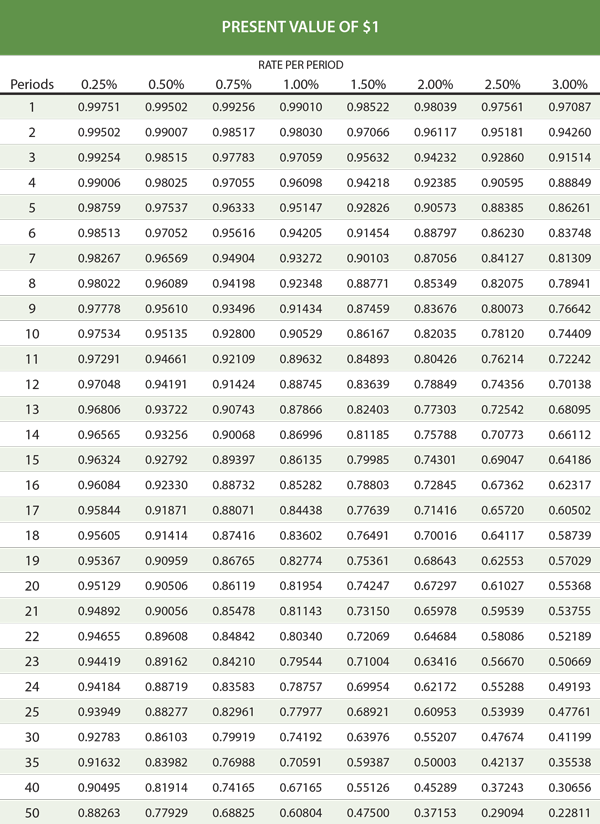

Present value of lump sum table

The table helps an investor in making informed decisions while planning for investments. The plan must use reasonable assumptions or factors but does not have to use 417e applicable interest and mortality rates to determine the present value of accrued benefits for any other distributions subject to IRC 417e that are calculated on a lump sum-based formula such as.

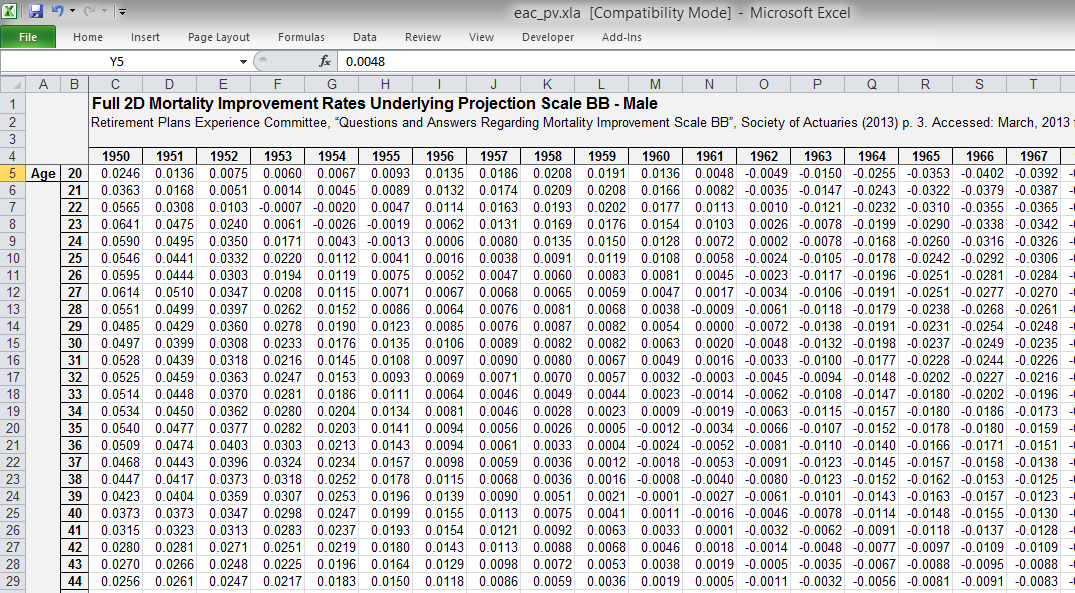

Actuarial Present Value Mortality Tables Rp2014 Present Value Of Annuity Scale Aa Scale Bb Scale Mp2014 Endres Actuarial

These mortality tables are also relevant for determining the minimum required amount of a lump-sum distribution from such a plan.

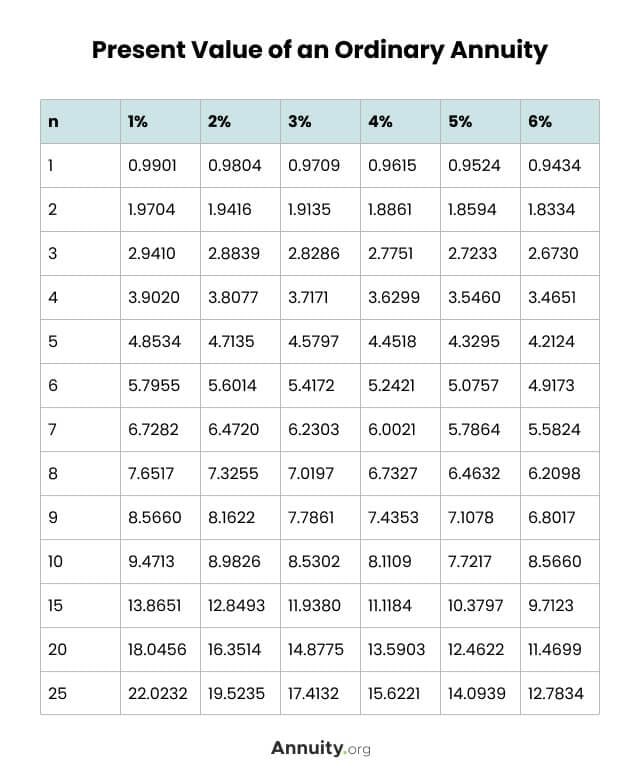

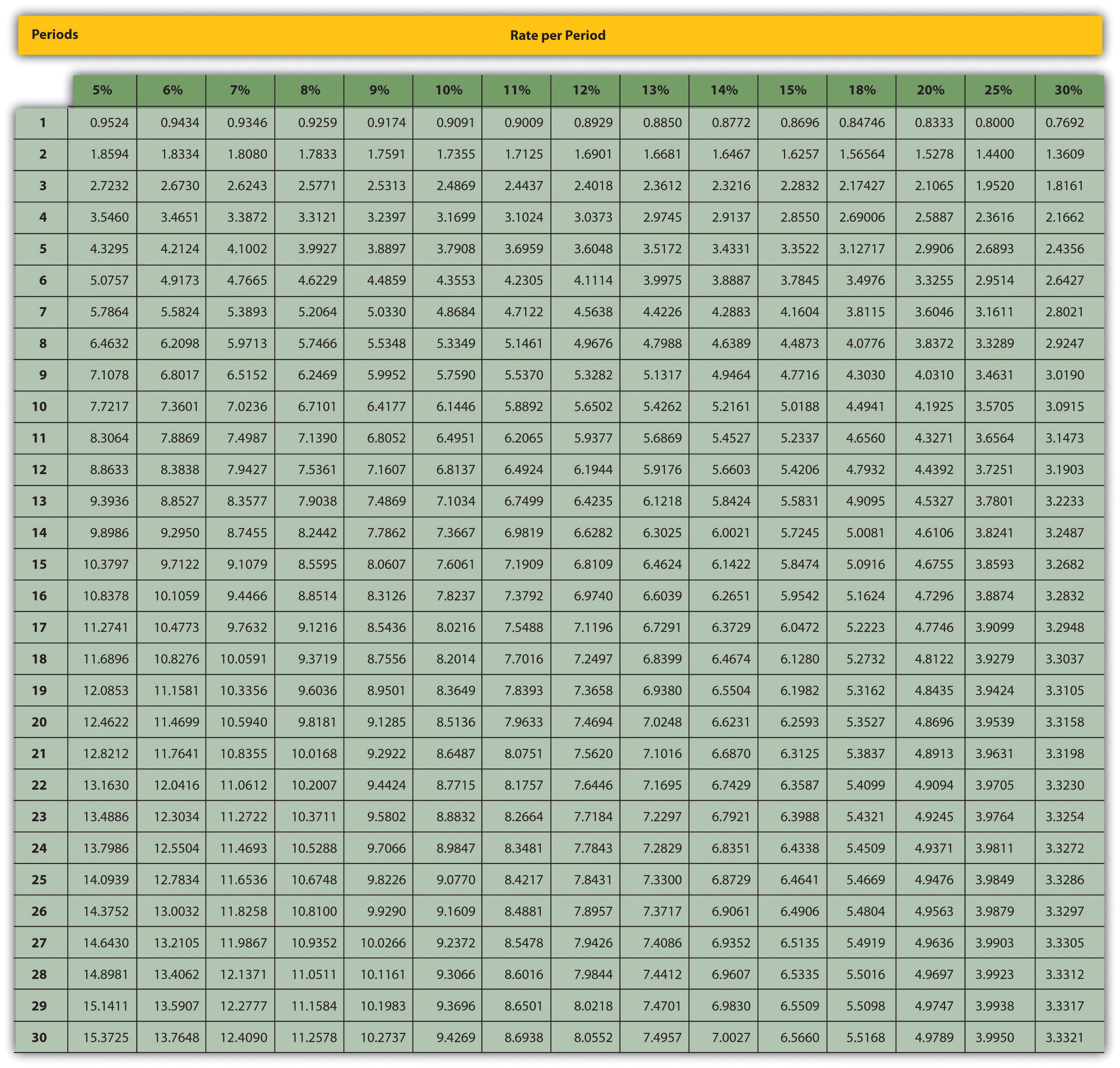

. This is because the payments you are scheduled to receive at a future date are actually worth less than the. Assuming that you can safely withdraw 4 of a portfolio annually without touching the principal I would need a portfolio of approximately 390000 in 2046 to withdraw. Using present value of an annuity table it is possible to calculate how much the lump sum of the annual payments would be currently.

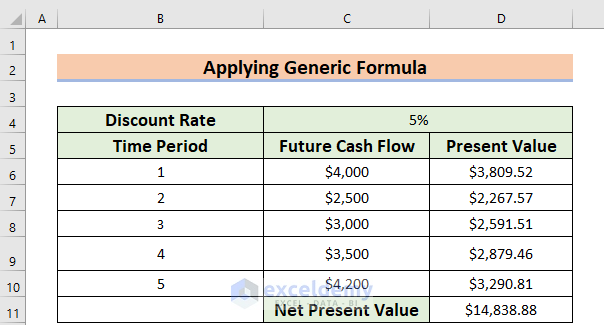

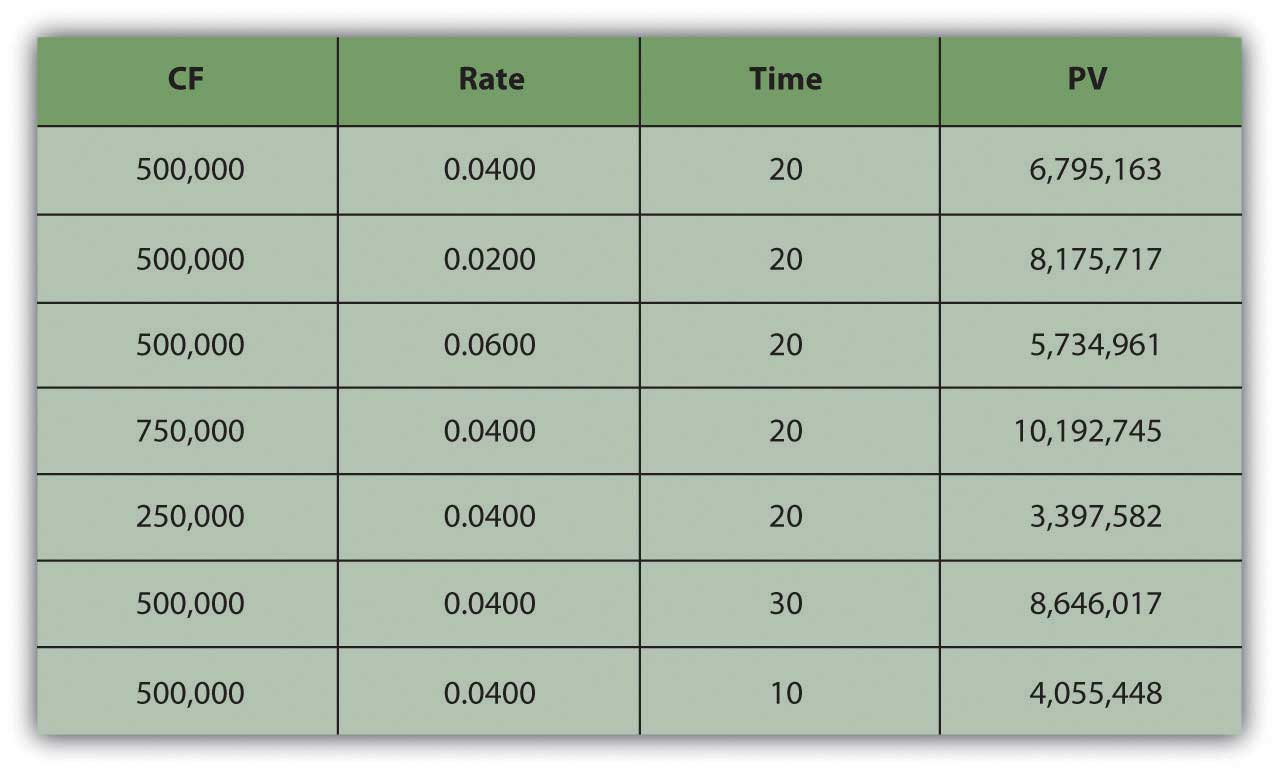

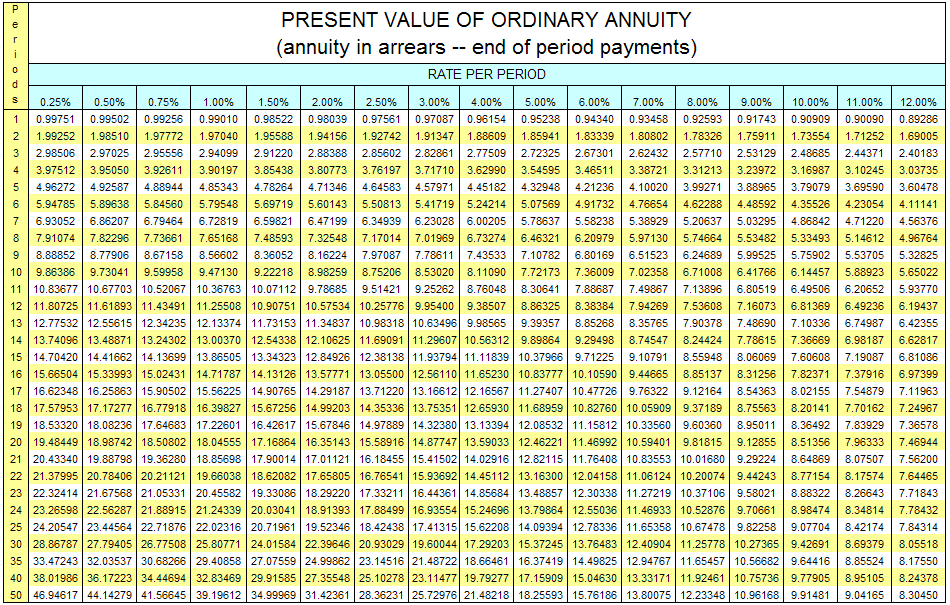

Present Value of 1 Table PVIF Present Value Formula Derivations. For example it can help you determine which is more profitable - to take a lump sum right now or receive an annuity over a number of years. It calculates the present value and future value of the annuity considering the value and the time period of the investment.

When talking about a single cash flow ie. Here are four methods you can use to make this calculation. Here we also discuss the Graphs vs Charts key differences with infographics and comparison table.

Only OP R and R for each year are needed to obtain LSEP and TTF. The tables are used together with other actuarial assumptions to calculate the present value of a stream of expected future benefit payments for purposes of determining the minimum funding requirements for the plan. An annuity table or present value table is simply a tool to help you calculate the present value of your annuity.

Enter the dollar amount as the future lump sum. Due to the complexity of the calculation people use the table. Table B illustrates this methodology for evaluating the projected LSEP of an enterprise where royalty has been made applicable for a period of 5 years.

PBGCs benefit payment regulation CFR Part 4022 provides that when PBGC trustees a plan if the value of a participants benefit is less than 5000 PBGC will generally pay that amount in one lump sum in lieu of a monthly annuity. The present value of a single amount allows us to determine what the value of a lump sum to be received in the future is. Future cash flows are discounted at the discount.

Based on the time value of money the present value of your annuity is not equal to the accumulated value of the contract. Calculate present value of lump sum and investments and future value of investments given interest earned and inflation variables. ERISA 4022 Lump Sum Interest Rates.

This table provides the monthly segment rates for purposes of determining minimum present values under section 417e3D of the Internal Revenue Code. The present value of a sum of money is one type of time value of money calculation. Prior to 2021 PBGC used an immediate and deferred interest rate structure for this purpose.

Bidding vs Auction. Generally for plan years beginning after December 31 2007 the applicable interest rates under Section 417e3D of the Code are segment rates computed without regard to a 24 month average. Bank Draft vs Certified Cheque.

You may also have a look at the following articles to learn more. The study looked at rolling 10-year returns on a 1 million portfolio from 1950 until the present day and lump sum came out better no matter whether an investor bought all stocks a mix of stocks. Present Value Interest Factor - PVIF.

Annuity vs Lump Sum. Annuities are either lump-sum payments or multiple payments made at regular intervals. Use the interest rate at which the present amount will grow.

The following table lists currently available rates for savings accounts money market accounts and CDs. How to mathematically derive present value formulas for a future sum annuity growing annuity perpetuity with continuous compounding. In everyday life the present value comes in useful too.

Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Present Value Discount Rate. The sum of PVs results in the Net Present Value NPV.

The present value of an annuity table is a table which shows calculations of the present value of an annuity factor. Charts will present the information or the data in the form of diagrams graphs or tables. The value in the table is used in place of this part of the formula.

One payment period the present value formula is as simple as this. Together with a lump-sum payment of 32000 risk-free income on. Present Value - PV.

To calculate the future lump sum amount that equates to receiving 1300 a month I first tallied up the yearly value of the payments which is equal to 15600 1300 x 12. 10-year periodic payments with no life annuity payments after. The present value interest factor PVIF is a factor that is utilized to provide a simple calculation for determining the present value dollar amount of a sum.

Present Value Tables Double Entry Bookkeeping

Present Value Of 1 Principlesofaccounting Com

Time Value Of Money Board Of Equalization

Calculating Present Value Accountingcoach

Annuities Amortization Present Value Lump Sum Payment And Balance Due Anil Kumar Lesson Gcse Ibsl Youtube

Solved The Table Shows The Lump Sum Amount Of Money Chegg Com

Present Value Of A Single Amount Quiz And Test Accountingcoach

Present Value Of A Lump Sum Formula Double Entry Bookkeeping

What Is An Annuity Table And How Do You Use One

Annuity Present Value Pv Formula And Calculator Excel Template

Present Value Of 1 Dollar Online 50 Off Www Ingeniovirtual Com

How To Calculate Present Value Of Future Cash Flows In Excel

Solved Exercise 11a 3 Basic Present Value Concepts L011 5 Chegg Com

Valuing A Series Of Cash Flows

Lottery Winner S Dilemma Lump Sum Or Annuity

2

Future Value Factors Accountingcoach